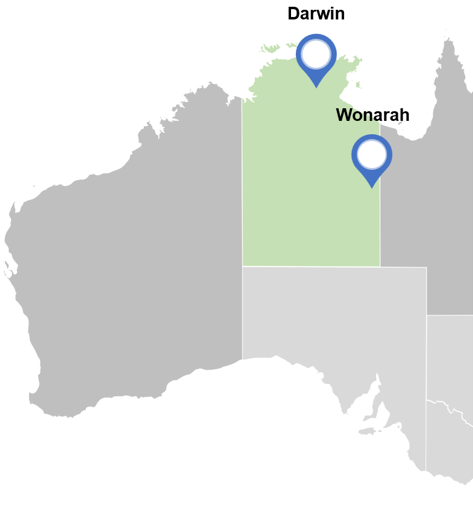

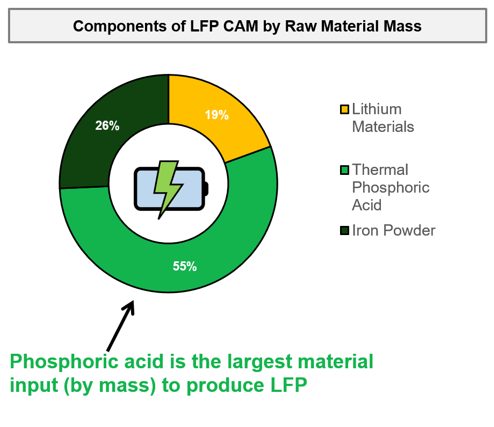

Geographic proximity to the under-supplied raw materials required to produce LFP, enables Avenira to have significant cost and logistical advantages relative to other LFP producers

Source: BBC, “How Australia became the world’s greatest Lithium supplier” dated 11 November 2022

Source: UTS, “Hidden casualty of Russia’s war, global phosphorous security dated 9 June 2022

Avenira intends to initially develop the LFP Plant as a standalone project, with feedstock (including TPA) secured from third party providers and further work is required to determine whether there is a reasonable basis for AEV to expect it can extract commercially sufficient high grade phosphorous from the Wonarah project for the LFP plant.

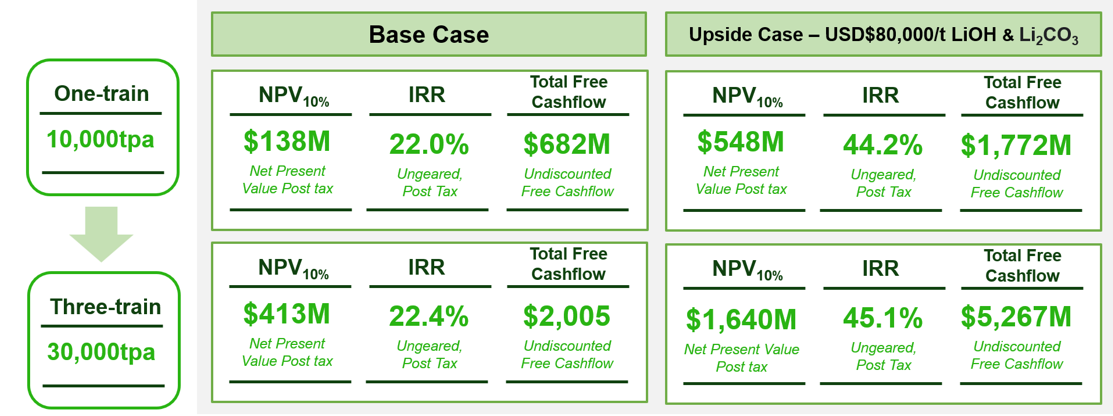

The economics of the LFP Project has been considered at two scenarios, a one-train plant with capacity of 10,000tpa and a three-train plant with capacity of 30,000tpa, under both spot and forecast Lithium prices

Aleees is only one of three companies outside China with complete LFP cathode manufacturing capabilities, and patents for electric vehicle and stationary storage batteries

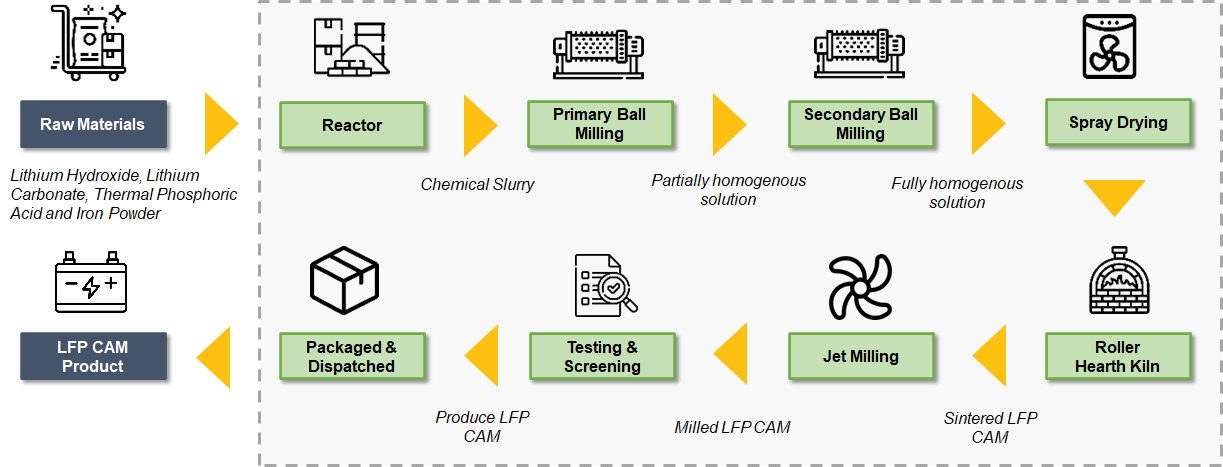

Avenira’s LFP Plant intends to adopt the patented LFP CAM synthesis process developed by its technology partner, Aleees. The following simplified block flow diagram illustrates the stages of the manufacturing process: